Another instance in which having a suspense account comes in handy is when a trial balance is out of balance, meaning the debit and credit columns do not match. Just like any to-do pile, the suspense account cannot hold your mystery amounts forever, and its proper place will need to be determined. Businesses may decide to clear their suspense accounts quarterly, while smaller companies may do so more often. It is vital to understand that all the transactions are temporarily recorded in this account. Although there is no standard amount of time set by regulatory authorities to clear this account. Ultimately the accounting team must move all the transactions into their correct accounts as soon as they can ascertain their exact nature.

An accountant was tasked with recording a few journal entries written by a large corporation’s finance director. One transaction’s nature could not be determined at the time of recording. To meet the deadline, the accountant entered the “unclassified” amount into the general ledger suspense account.

Importance of a Suspense Account

When it comes to your transactions, automatic bank reconciliation can help you match your payments in an instant. Alternatively, the transaction can be left in the daybook while you consult your accountant or bookkeeper and the correct account can be determined at a later date. Whether you are a new or seasoned business owner, you should have accounting software to help you.

Andre Yarme, Harbor make quick work of Aptos in sweep Boys volleyball – Santa Cruz Sentinel

Andre Yarme, Harbor make quick work of Aptos in sweep Boys volleyball.

Posted: Fri, 21 Apr 2023 07:51:21 GMT [source]

The accountant will then credit the suspense account with $50 and debit the cash account with the same transaction amount. When the company gets the entire payment from the customer, they will debit $50 from the suspense account and credit the receivable accounts with the same amount. When the process is finished, the accountant may finally terminate the suspense account and transfer the money to the correct account. A suspense account is needed because the appropriate account was not determined at the time the transaction was being recorded. As long as a transaction is found in a suspense account and hasn’t yet been transferred to its permanent account, it is placed in the suspense account, acting as its holding account for the transaction. Having a larger number of unreported transactions would mean that it won’t be recorded by the end of the reporting period, resulting in inaccurate financial outcomes.

This is entirely controlled by the SuspenseScreen rule, which is configured in the Rules Palette. With FreshBooks, you get accounting tools that make your business run smoother. Bookkeeping has never been easier thanks to FreshBooks’ double-entry accounting. Your figures will be accurate and your amounts equal when you have FreshBooks in your corner. Sarbanes-Oxley Act of 2002, it’s required that the accounts are analysed by the type of product, its aging category, and business justification, so that it’s understood exactly what is in the account.

Clearing Out Suspense Accounts

In short, a suspense account is the point of last resort when you need a short-term holding bay for financial items that will end up somewhere else once their final resting place is decided. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups. The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless.

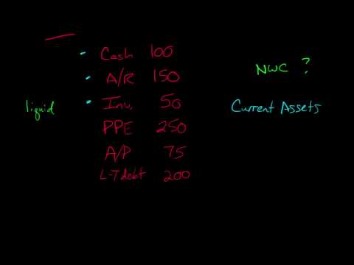

If a payment is made to the business but the accountant does not know who sent it, the sum must be placed in a suspense account until additional inquiry is completed. Once the accountant has reviewed the invoices or other communications and validated them with the client/customer, the funds can be sent to the appropriate account. A suspense account is helpful in a trial balance when the debit and credit totals do not match. The difference in debit and credit balance can result in creation of a suspense account. This balance is debited if the credit balance is larger than the debit balance.

Red Sox win against the Twins decided in a see-saw, full-of-suspense 10th inning – St. Paul Pioneer Press

Red Sox win against the Twins decided in a see-saw, full-of-suspense 10th inning.

Posted: Wed, 19 Apr 2023 02:33:59 GMT [source]

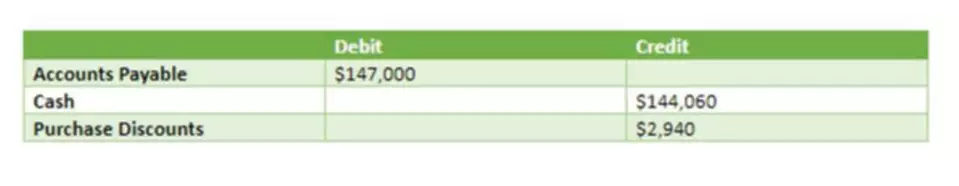

This prevents unknown transactions from being placed into the wrong areas of the general ledger. For example, your accountant would use the payroll suspense account for unknown pay-related distributions. She wouldn’t place an unknown asset transaction into the payroll suspense account, she would put it into a suspense account related to assets. After which, they need to debit the suspense account and credit the accounts payable.

And the default retained earnings account acts as an all-purpose vessel to ensure the safety of the funds. Partial payments, whether intended or unintentional, can be difficult to reconcile with bills. The accountant or those in control can place the payments in a suspense account until they can determine whose accounts the transactions belong to. For example, if a financial institution gets a $50 partial payment from a customer, it must first create a suspense account. No, you do not need to close your suspense account as long as you are keeping track of uncorrected transactions.

Example 2 (with Journal entry):

The money from investors is deposited into this account when making decisions about their investments. The suspense account is used when a client does not know what to do with the deposit or funds. As the client works to make this decision, the money can stay in this account for a few days as needed. Having an outstanding balance in a suspense account does not generally reflect well on a business’s financial statements.

- These payments are thus kept on hold and get transferred to a suspense account until this problem is rectified and the invoice is determined.

- A unique suspense number is generated with each suspense record for identification purposes.

- Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital.

- A general ledger helps to achieve this goal by compiling journal entries and allowing accounting calculations.

- Some jurisdictions have rules and regulations regarding suspense accounts because they are considered a control risk.

On your trial balance sheet, include the suspense account under “Other Assets.” After you’ve made the necessary changes, close the suspense account so it’s no longer a part of the trial. Your mortgage lender may also use a suspense account for overpayments. For example, if you always round up when you write out your check to pay the mortgage payment, the servicer might put those funds in a suspense account. Or the amount might go toward reducing the principal balance of your mortgage. Today, online accounting and invoicing software like Debitoor gives you the tools to easily manage your income and expenses, from anywhere.

The aim of a suspense account in balance sheet terms is always to be a balance of zero, as this means that everything has been correctly recorded, and there are no anomalies unaccounted for. A company’s general ledger needs to show all of your organisation’s financial accounts, including your suspense account. Then, we close the account after making the necessary adjustments so that it’s no longer part of the trial balance.

Resources for Your Growing Business

Cash on delivery is a type of transaction in which payment for a good is made at the time of delivery. An amortization schedule is a complete schedule of periodic blended loan payments showing the amount of principal and the amount of interest. An accounting error is an error in an accounting entry that was not intentional, and when spotted is immediately fixed. Andrew Bloomenthal has 20+ years of editorial experience as a financial journalist and as a financial services marketing writer.

There is an uncertainty regarding transaction classification at the time of its entry into an accounting system. Explore the future of accounting over a cup of coffee with our curated collection of white papers and ebooks written to help you consider how you will transform your people, process, and technology. From onboarding to financial operations excellence, our customer success management team helps you unlock measurable value. Through workshops, webinars, digital success options, tips and tricks, and more, you will develop leading-practice processes and strategies to propel your organization forward. F&A leadership can have a significant impact by creating sustainable, scalable processes that can support the business before, during, and long after the IPO.

The currencies of each suspense item must match the premium currency selected on the activity. Activity currencies are defined in the Activity Details section when the Add Activity button is selected and an activity is added to the policy. When a suspense record is entered via the Suspense screen it is initially given a status of Open, meaning the full amount has not been attached to a policy or policies. Once the entire suspense record amount is attached to one or more policies, the suspense record’s status is automatically changed to Closed and no more money may be attached to the record.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

It remains temporarily suspended until further research reveals its destination or classification. Suspense account transactions are also attributed to the world of investing. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Best Arbitrage Mutual Funds to Invest in India in April Arbitrage funds are hybrid mutual fund schemes that aim to make low-risk profits by buying and sell…

If, however, there is only a suspense account he can draw only up to £10 per week. £50,000 was being held in a suspense account until the copyright dispute was cleared up. As its name implies, this account is reserved for an unidentified transaction.

For example, a dispute between departments about who should be charged for a bill may be placed into the suspense account until it is figured out. See what a suspense account is and understand its different types. Error corrected with a journal entry for the difference amount between the affected ledger account and the suspense account.

The format of suspense account entries will be either a credit or debit. Also, enter the same amount with an opposite entry in another account. Eventually, you allocate entries in the suspense account to a permanent account. There is no standard amount of time for clearing out a suspense account. Most businesses clear out their suspense accounts monthly or quarterly. In accounting for small business, most suspense accounts are cleared out on a regular basis.

If you’re not sure where to enter a transaction, set up a suspense account and consult with your accountant. In this article, we will learn about the balance of Suspense Account, the use of a suspense account and examples of suspense account. But because this amount isn’t enough to cover the November payment, it will go into suspense, and the cycle will continue. Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. Finally, a fourth variant allows the sponsor to transfer all the excess assets into a suspense account that can then be allocated to workers’ defined contribution accounts over seven years. When customer withdrawal completes, the money moves from suspense account to the agent’s account who facilitated the cash withdrawal.

It allows the business to stay organized by separating unknown transactions. Let’s suppose you receive a payment from an unknown entity; or the sender is known but you are not sure which invoice they are paying for. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital. Automate, optimize, and manage intercompany non-trade transactions. Centralize, streamline, and automate end-to-end intercompany operations with global billing, payment, and automated reconciliation capabilities that provide speed and accuracy. Ignite staff efficiency and advance your business to more profitable growth. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

There can be lack of surety regarding a payment made by a client with respect to the accounts receivable balance. In these situations, a suspense account is passed to match the outstanding dues with payments and verify them with the client. If a business receives a payment from a messenger, but the original client only lists their first name on the envelope without listing their full name, this may be placed into the suspense account. Once the client calls the business to confirm the payment was received, the business can move that payment to the correct account. The suspense account stores unclassified or unknown money that is not linked to a set account. These accounts are used to resolve issues and improve accuracy for accounting purposes.

An incomplete transaction should neither be overlooked nor entered improperly. The suspense account provides a place for accountants to temporarily log and track incomplete transactions until more information is obtained. Increase accuracy and efficiency across your account reconciliation process and produce timely and accurate financial statements. Drive accuracy in the financial close by providing a streamlined method to substantiate your balance sheet.